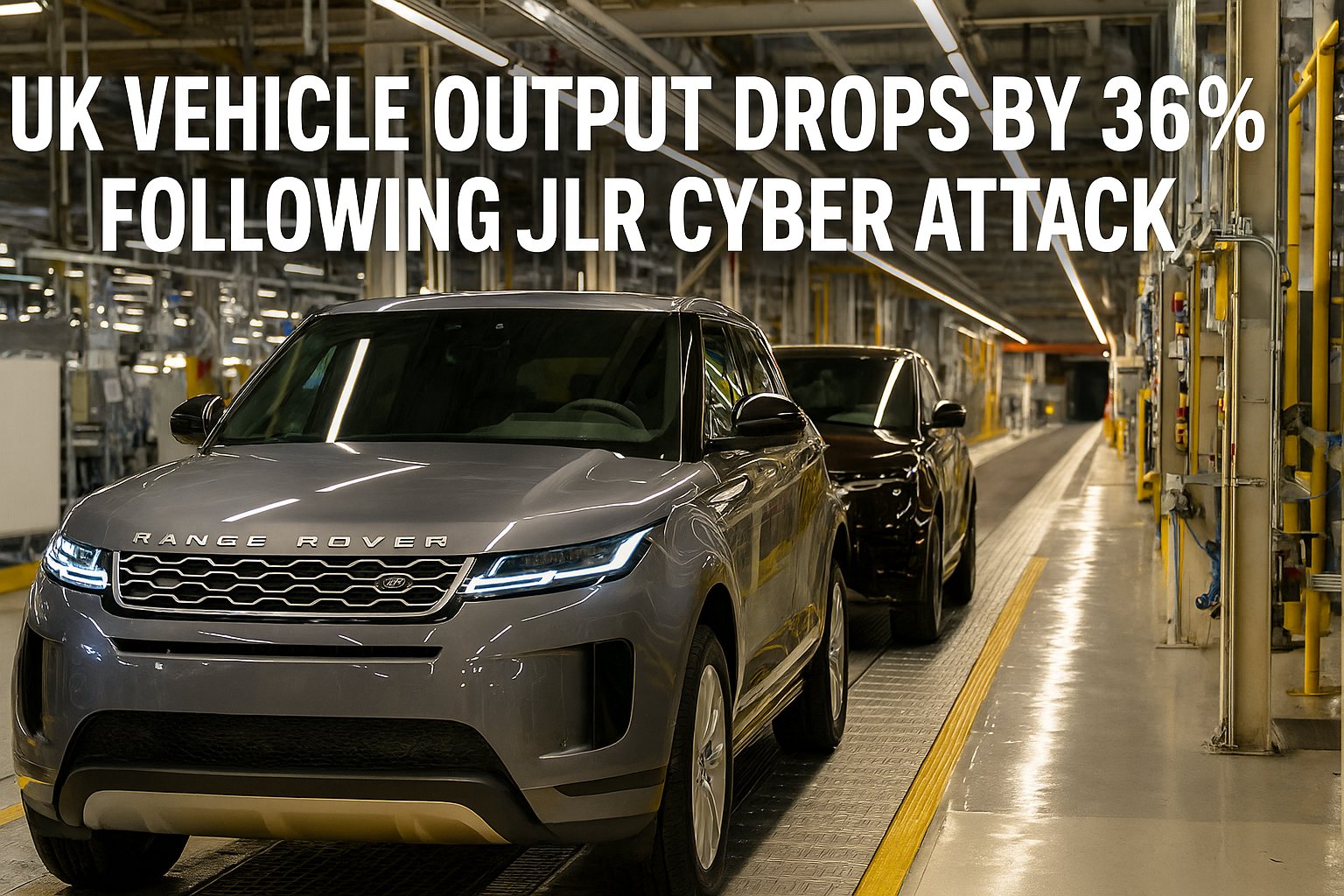

In a dramatic turn for Britain’s car-manufacturing sector, UK vehicle output fell 35.9% last month, largely as a result of the cyber-attack that paralysed Jaguar Land Rover (JLR), the country’s largest carmaker. Autocar+2Trading Economics+2 According to data from the Society of Motor Manufacturers and Traders (SMMT), no other major UK manufacturer reported a decline — rather, others such as Nissan UK, Stellantis UK and Toyota UK saw rises in production — underscoring the scale of JLR’s disruption. Autocar+1

As of 16 October, JLR had resumed operations at all its UK plants, with its Halewood site (which builds the Range Rover Evoque and Land Rover Discovery Sport) returning last. Autocar+1 However, the pause in production is expected to have far-reaching consequences for Britain’s automotive manufacturing sector and the supply chain that supports it.

1. What happened: the cyber-attack and shutdown

The timeline is stark. In early September, JLR detected a major cyber-security breach, prompting a full system shutdown at its three core UK manufacturing sites. Industrial Cyber+1 By late September and into early October the company began a phased return to production. The disruption lasted for several weeks, during which no cars were built at the factories in Solihull, Halewood and Wolverhampton. AP News

Because JLR produces around 1,000 vehicles per day in the UK, the downtime translated into tens of thousands of un-manufactured vehicles — a hit not only to JLR but to its battery, parts and logistics supply chain. Industrial Cyber+1

2. The production drop: figures and context

The SMMT figures reveal a drop of 35.9% in total vehicle output for the UK in the affected month. Autocar+1 Car output alone fell by approximately 27% year-on-year. The Guardian Meanwhile, van and commercial vehicle output also plunged, although the primary driver of the decline is clearly concentrated in passenger car production tied to JLR.

One key point: other UK manufacturers reported increases in volume this same period, meaning the drop is almost entirely attributable to the JLR shock. Autocar

3. Broader impact: Supply chain, employment and economy

The disruption extends well beyond JLR’s factory gates. The manufacturer directly employs over 30,000 people in the UK and supports hundreds of thousands more in the supply chain. The Guardian+1 With the production halt, many component suppliers found themselves without orders, causing ripple effects in smaller towns and the broader manufacturing base.

For example, each day of shutdown at JLR equates to millions in lost revenue, and suppliers had to scale back or pause operations as they awaited the restart. Industrial Cyber The SMMT has warned that such interruptions weaken the resilience of the UK auto-industry when it needs to transform for electrification and global competition.

4. What this means for UK automotive manufacturing

a) Electric vehicle transition under pressure

The UK car-manufacturing base is in the midst of shifting toward electric vehicles (EVs) and plug-in hybrids, requiring heavy investment in new lines, battery assembly and supply chains. A shock of this magnitude delays that transformation and raises risk. For example, any delay in JLR’s EV lines may hold back broader UK EV ambitions.

b) Competitive vulnerability

While other UK brands managed to increase output, the fact that one major disruption caused a third of output to vanish shows how concentrated risk still is. The industry must diversify, build shorter supply-chains and improve cyber-resilience.

c) Government and policy implications

The government faces pressure to support suppliers, protect employment and strengthen industrial policy. The SMMT has already called on the government to retain favourable schemes (such as employee-car ownership plans) and to invest more in competitiveness against overseas rivals. The Times+1

5. Recovery path and what to watch

JLR has begun the phased restart, but full capacity may not be achieved until early 2026, according to industry commentary. The Times+1 The speed of ramp-up will influence UK production volumes going forward. Key metrics to monitor include:

- Monthly output change for UK vehicle manufacturing (SMMT-reported).

- JLR’s production numbers and how many vehicles were lost/unbuilt.

- Supplier restart timelines and whether supply-chain bottlenecks persist.

- Government policy measures and industry support for resilience and electrification.

6. Key takeaways

- UK vehicle output collapsed by nearly 36% in the latest monthly data — a staggering decline driven almost entirely by the cyber-attack at JLR.

- The disruption highlights the fragility of the UK auto manufacturing sector, especially given its crucial role in transitioning to EVs and facing global competition.

- Suppliers and jobs are at risk; the broader manufacturing base must focus on resilience, diversification and policy support.

- The coming months will show how fast production can return — and whether UK manufacturing can regain momentum in the face of global headwinds.

SEO & AdSense/AdX compliance tips

- Use the focus keyword (“uk vehicle output drops 36 %”) in the title, early in the opening paragraph and a few times naturally throughout the article.

- Use headings (H2/H3) to break the content for readability and SEO.

- Include at least one high-quality image (e.g., JLR factory or UK car-manufacturing plant) with alt text referencing the focus keyword.

- Provide internal links to other relevant content on your site (e.g., articles on UK EV manufacturing, JLR strategy, auto supply-chain reports).

- Provide outbound links to reputable sources (such as the SMMT, Reuters, Autocar) for trust and authority.

- Ensure the article is mobile-friendly and loads swiftly; keep paragraphs short (~3–4 sentences) for good user experience.

- Avoid over-use of the keyword (“keyword stuffing”); maintain natural tone and readability.

- Make sure any ads don’t interfere with user-experience—AdSense/AdX placement needs to follow policy (no intrusive interstitials, no obstructing content).

- If using affiliate links (e.g., for industry reports, manufacturing analytics subscriptions), ensure they are clearly disclosed and relevant.